Korean plastic surgery, while often cheaper than Western alternatives, still represents significant investment. Understanding financing options helps make surgery accessible without financial strain.

Korean clinics typically don't offer direct financing to international patients due to credit verification challenges. However, several alternatives exist:

Medical credit cards from your home country often cover international procedures if properly documented. Companies like CareCredit (US) offer medical-specific financing with promotional interest rates.

Personal loans from banks or credit unions provide fixed rates and predictable payments. Apply before traveling to ensure fund availability.

Some medical tourism agencies offer payment plans, essentially acting as intermediaries who pay the clinic while you repay them over time. Research these carefully—interest rates and terms vary widely.

Health savings accounts (HSAs) may cover certain procedures if medically necessary, though cosmetic surgery generally doesn't qualify. Consult your tax advisor.

Important: Never put yourself in financial hardship for elective surgery. If you can't comfortably afford a procedure, consider saving longer or staging surgeries over time. Quality clinics won't pressure you into immediate decisions.

Clinic Introduction

Clinic Introduction

Medical Facility

Medical Facility

Patient Care

Patient Care

Consultation Room

Consultation Room

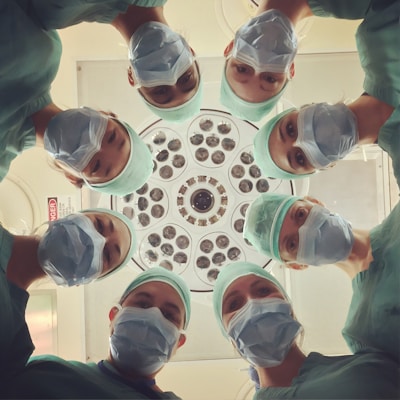

Medical Staff

Medical Staff

Recovery Suite

Recovery Suite

Treatment Room

Treatment Room